The Value of Blockchain & Cryptocurrency Resides In Community

By Nicholas Krapels - Member of FinTech Connector / Shanghai

When discussing the value of Bitcoin (BTC), engineers explain the ability of its unique technology to store an immutable record of transactions from the genesis block in 2009 to the end of time immemorial. With the Bitcoin blockchain, cooking the books or double spending the same unit of currency is impossible. BTC is an international store of value. Tasteless, odorless, borderless, soulless, and incredibly inexpensive to transfer large monetary values to anywhere in the world.

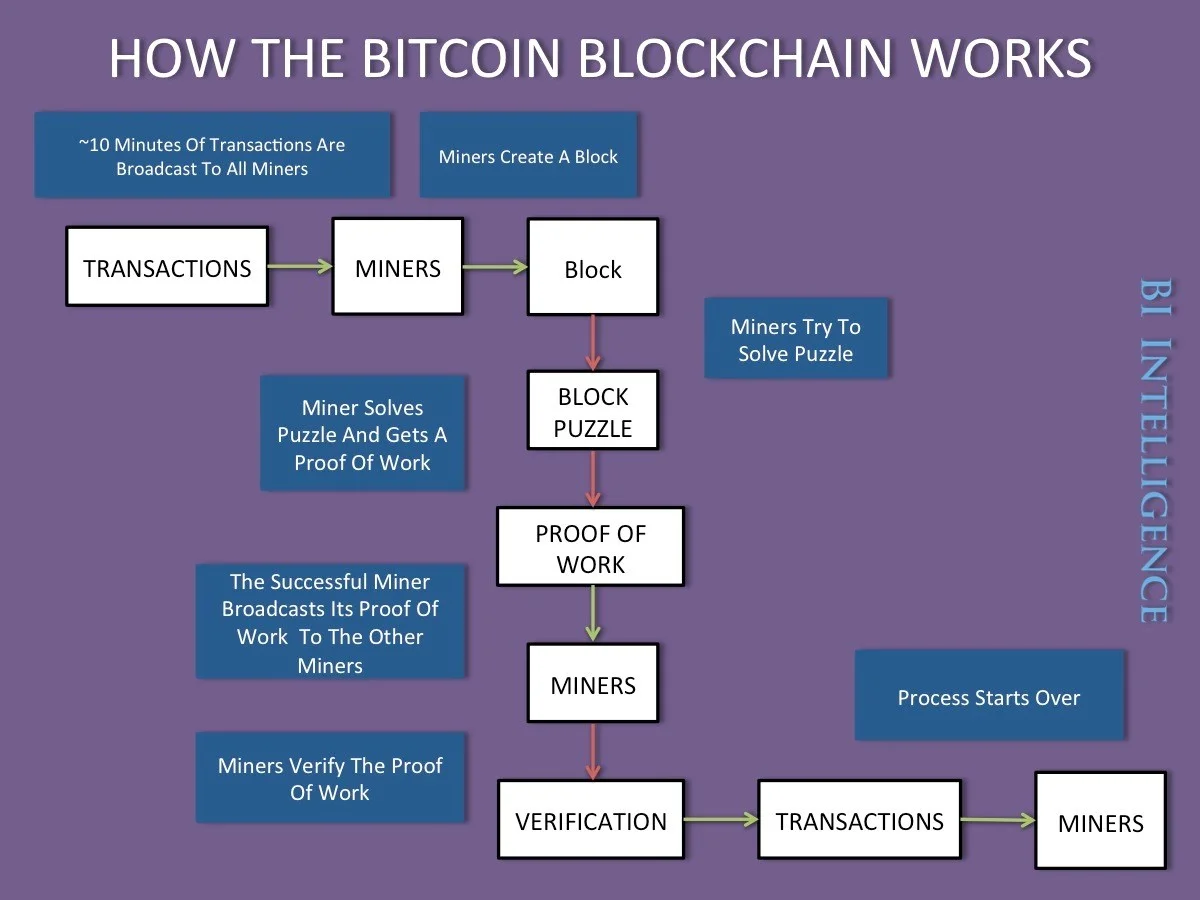

If you talk to a blockchain engineer for any significant amount of time, they will probably also describe the role of miners in the process that both secures the Bitcoin blockchain and mints new bitcoins at the rate of 12.5 BTC every 10 minutes. You most likely won’t understand half of what the engineer you’re talking to is saying, but it will be some kind of verbal equivalent to the following diagram:

Technologists focus on these types of issues to justify the value of a Bitcoin.

But I disagree.

The value of bitcoin does not primarily lie in the billions of dollars of hardware and electricity spent on its pursuit, though certainly that is worthy of a significant proportion. After all, financial capital and most importantly "work," in the manner that Bitcoin's proof-of-work protocol implies, are included in that valuation. But the value of that "work" does not exceed the value of the social community that is de facto created around Bitcoin and every other cryptocurrency, cryptoasset, and/or digital token.

I may just be a mere adjunct finance professor toiling away for bread crumbs by the flourescent-pure halogen light of a temporary office, but to me, the most valuable aspect of the so-called "commodity" of bitcoin lies far beyond all its bleeding-edge tech.

This particular insight - that the primary value of bitcoin lies in its community - is particularly useful in describing the value of bitcoin to people who are only casually interested in the subject. Maybe their friend has recently made a mint. Or they have an entrepreneur buddy readying his blockchain startup. They may even have a Coinbase account with ether and bitcoin in it.

This demographic is the group of people - the casual observers, the technically proficient yet overworked aspiring middle class, that bitcoin/blockchain/crypto has, until now, had trouble reaching out to and "exciting the base." I might be using a political science term in an inexact way, but I think it is an appropriate phrase here.

What I mean is crypto aficionados no longer all look like this:

The idealist iGeneration nerds are no longer exclusively in charge of this field. Bitcoin, blockchain, and other cryptoassets have created an entirely new and booming subsector of the financial economy. That explosion in value and expectation means that marketers, salespeople, business strategists, community managers, analysts, crypto lawyers and accountants… all of these positions are out there for those people who are gaining interest in this field now, as opposed to the legion of “early adopter” miners and traders whose interest might have already peaked.

According to icodata.io, $6.3 billion and counting has been raised so far in 2018. All of this ICO money eventually has to go somewhere, right?

If approximately a billion dollars gets raised every month by blockchain startups, all that money eventually ends up in somebody's pocket. For many companies, that competition will require hiring the best talent at premium prices. Michael Spence’s job market signaling theory postulates that as higher salaries consistently appear in a budding industry, better talent will be attracted to that industry, as well as certificates and educational courses that attest to that talent. However, we are not there yet. Developing blockchain curricula is not easy, and even though many educational institutions have made this target a primary goal, the snail’s pace of academia ensures that we are still far away from any reliable measure of blockchain talent. Thus, it may take a few years to develop the talent pipeline to populate the payrolls of a new and growing tech sector. Until then, it takes a village. Communities all over the world are coalescing around the topic of blockchain and beginning to self-regulate themselves.

The blockchain industry is being born at crypto speed. Countries are variously, and certainly in a three-steps-forward-and-two-steps-back kind of way, as we often tend to observe in China, are making their peace with blockchain in general and even some cryptocurrencies in particular. If blockchain is now going to occupy a certain and growing niche in the financial sector of the economy, then it needs fully-formed communities and mature organizations. These groups of people are necessary to provide both regulatory constructs and more amiable opportunities to grow, network, and nurture each other. In a manner that befits the blockchain, those institutions are cropping up in an efficient and decentralized manner. The topic is already being actively academicized and certificates of study and accomplishment are proliferating. Taiwan, South Korea, Singapore, Hong Kong and other domiciles are moving forward with the development of their respective blockchain economies with a “light touch” regulatory approach. For now, such an accommodative stance towards blockchain results in a kind of Wild West mentality. However, as self-regulating organizations and legislative advisory bodies proliferate, lawlessness should subside.

As the industry develops, increasingly more and varied types of people will begin to actually work in the industry, as opposed to just raising money. A more diverse workforce will naturally begin to erode some of the negative shine associated with blockchain’s hipster-cool exclusivity. Many people see the bitcoin/blockchain/crypto industry as kind of an ultra-niche product, not necessarily deserving of the revolutionary status that has been thrust upon it. This perception, in turn, tends to work against the burgeoning industry in the cultural milieu. Combined, these perceptions have conveyed upon bitcoin enthusiasts this sort of bon viveur status in popular culture, an "encrypted allure" if you will. A decade after its invention, bitcoin is now, finally, shedding its underground look.

Amazingly, that transformation seems to be happening faster than even the most hardcore bitcoin maximalist could have imagined.

Here is where I can only draw on my own personal journey in researching blockchain and cryptocurrency. For me, and I think for a lot of people when they first start thinking about bitcoin, the first question that comes to mind is:

Where does Bitcoin derive its value?

It’s a great question!

When I would ask other crypto enthusiasts this question, typically I'd hear the hipster version of the story, that of a revolutionary renegade technology out to Mr. Robot the financial world.

They'd say things like:

• "If you're just gonna buy this stuff on Coinbase, then you might as well not even buy it. If you don't own yer private keys, you don't own yer coinz!"

• "What's the best wallet? Oh, I don't know. It depends on a lot of things. If you don't know, I'm not gonna tell ya. It's kinda complicated."

On the other side of the spectrum, the siren song of the rapt technologist rambling on about a fabulous fairy tale of a distributed cryptographic immutable ledger further secured by the alignment of economic incentives inherent in something called "proof of work."

After you unpack that bolded statement above, which can take anywhere from a month to a year, depending on how familiar you are with some of the already complex concepts – computer science, economics, finance, philosophy, politics, psychology, etc. – that are required to reach blockchain nirvana, you are still just starting to scratch the surface of the blockchain topic as a whole. For me, I was lucky in that I already understood the importance of economic incentives at least, and had at least some idea about the concept of computer programming in different languages. What I mean is like, uh, I once knew what a .css style sheet was.

Along your blockchain edification journey, you are constantly encountering new tangential topics that you just think you might never wrap your head around. But then you do.

Sometimes that's the process of understanding required in order to understand just one concept in the bitcoin/blockchain/crypto space. Even after you unpack all that, and then sometimes unpack that, and then unpack that, ... then hopefully you are able to explain, as simply as possible, each of the four unique aspects of the bitcoin blockchain with any of a variety of conversational partners from the most casual observer up to the leading luminaries of this burgeoning field.

Decentralized.

Cryptographically secured and verified.

Immutable.

Distributed Ledger.

Once you can do that off the top of your head, as all good technologists can, I myself still come back to one overreaching and vital element of bitcoin and blockchain's success. It's an element that very few people in the industry really talks about, at least in the specific terms that I will attempt to explain here.

Yes, I know what some people are gonna say.

It's 2018 and what's cutting-edge is social media marketing, so it follows that cutting-edge technology will employ some pretty sophisticated online viral marketing tactics. And yeah, we're seeing a lot of that. The space is exploding with creativity, usually of the growth hacking variety.

But that’s really not what community is.

Having 99, 537 accounts in your telegram supergroup is not a real community. Active members that engage with each other, taking the time to explain the concepts they know and curious to find out other perspectives is REAL COMMUNITY. And that, for the most part, still requires at least some face-to-face interaction.

That’s why the FinTech Connector mission, and other decentralized communities like CryptoMondays, is so important. People need to get together. Not only to blow off some steam. But to educate, improve, challenge, and inspire.

Therefore, when you are investing in the asset class that is bitcoin and cryptoassets, you are not really investing in the cold, hard technology as much as you are investing in the community of creators and visionaries that are behind that technology. Because at these valuations, you really aren't paying for what the technology is capable of today, investors are paying for what the technology could be, in the far, far future.

That value could end up being quite a lot. Some estimate that it will exceed the $10 trillion height of the dot-com bubble. Bitcoin maximalists believe that BTC alone will eventually exceed this value, to say nothing of the thousands of other cryptoassets that comprise the global crypto market cap maintained at Coinmarketcap.com.

But it will not be today's version of blockchain technology that will net that valuation. It'll be the iteration after the iteration after the iteration after that, that will drive value in the not-too-distant future. The people who develop the software and digital infrastructure that comprises "the blockchain" will be the primary determinants of the success or failure of each of those iterations.

In short, that's the value of any bitcoin/blockchain/crypto enterprise.

It’s the community.

People that gather together to inspire, to celebrate, to prod, to cajole, to support one another as they strive toward a future that they believe could change the world.

Who's to say they're not right?

Bitcoin, for example, comes with a fantastic community that loves, supports, and nurtures it. For some reason, they even passionately argue about whether its data blocks should be 1 MB or 8 MB, to the point that they even call each other names and get into virtual fistfights about it.

That's true passion!

Dogecoin (DOGE) is the perfect example. DOGE was named after a popular Japanese meme and cute-puppy-in-general basically as a joke, but a community grew up around the project and now it is a consistent top-50 blockchain with a $400 million valuation.

Alright, stop! What? The value of a community of cute dog lovers and crypto enthusiasts is $400 million? That's crazy. Yeah, I know what you mean.

But when you think about the kind of companies that are valuable today - the FANG and BATs of the world - they are the companies that build, maintain, nurture, and grow networks like LinkedIn, Instagram, Apple Store, Amazon Prime, etc. Those networks are so profitable because they are subject to network effects, which means that companies can grow at exponential rates for extended periods of time as long as they are expanding their network.

What drives those networks? These networks that are literally worth billions and billions of dollars to Microsoft, Facebook, and others derive their value from their users. Those users are people, not just data, and those people make up a community. Those communities right now have no stake in the networks that they are actively creating, maintaining, and growing.

That's wrong.

One of the great goals in crypto is to more equitably redistribute the power of a network. Where gatekeepers once extracted a heavy toll from their users, either in data or attention or both, without including them in any redistribution of profits, those business models are about to get majorly disrupted.

That's the power of the community that cryptocurrencies build. They are more than just a "Friday night beers" club for locals or some literary book-of-the-month club. These users literally bring the "network" in "network effects" to the decentralized networks that they frequent on a regular basis. They are literally what their cryptocurrencies derive their value from. It has a certain tautological elegance.

Bringing people around a common cause increases the value of the token that represents that cause.

This concept of value might be difficult to grasp at first. Difficult at least until you begin to think about what the value of any sovereign currency today is based on. Long gone are the days when a king hoarded a stash of gold in a dusty basement stocked with dragon skeletons and mead. Today's modern fiat currencies derive the majority of their value from the exact same place that bitcoin does. From the throngs and throngs of people who believe that those currencies can enable them to buy the necessities of life. If that faith gets shaken, well... Venezuela.

The difference between fiat and bitcoin is that crypto communities stand stronger together. On the grand human scale, they are a small but vocal few. Fiat enthusiasts are a fractured and disloyal tangled mass grasping for a grubstake in a game they can't win. At least with bitcoin we know approximately how many units that are going to be in circulation at the end of next month!

Let me describe the power of the bitcoin community via one amazing example.

Money 20/20 recently held a payments race where they pitted 5 racers, each with one form of payment method only, to a race across the United States. Against seemingly all odds, do you know who won?

Bitcoin.

Because of a community that has organically sprung up around a revolutionary technology and its "imaginary" currency created by an anonymous man who may or may not be Japanese or even one person.

That’s power.

And THAT is the true value of Bitcoin - the people who love it, the people who fight for it, the people that put their lives and their future on the line to educate, familiarize and proselytize the Bitcoin gospel.

In that sense, Bitcoin is very similar to the fiat money it may one day replace. It is said that the value of a currency can be measured by the number of people who have "faith" that it has certain value. In fact, the fiat in fiat money is a word derived from that very same "faith."

Whether that faith be supported by guns, butter, or mere "exorbitant privilege" as the French used to say, one can say that the US Dollar is currently very successful. Its current "market cap," to use the term in the way that the crypto markets employ, is an astounding $14 trillion. And it's literally growing every day. The supply of USD on the market increases, on average, almost $50 billion per month. By 2025 what will it be? No one knows. But at least we do know that there will only ever be 21 million BTC on this Earth.

Though the Bitcoin market cap hovers around $300 billion, a little more than 2% of today's money stock at the Federal Reserve, I can't help but notice that the Bitcoin community is awash with a lot more than just "faith."

It has fervor.

So when people ask me, "What determines the value of bitcoin?"

I can only respond with one answer and that answer...

That answer is you, dear reader. It is you - the curious sampler, the ostentatious gambler, the visionary firebrand, the inveterate young hustler, the dabbling technologist, the humble educator… Like I said, it takes a village.

Never forget that it is you that are going to be what makes (some of) these cryptoassets so valuable in the future.

The bitcoin and crypto-in-general community attracts some of the best people in the world. And some of the worst. But in my role at FinTech Connector as Shanghai community manager, most of what I see is a positive, vibrant community that is poised to create...

the next Silicon Valley... decentralized.

---

Nicholas Krapels is a Finance and Business professor at the East China Normal University and the Dayton University China Institute. Nick also advises a number of cryptocurrency and blockchain companies including DarcMatter where he serves as the Director of China Business Development. Lastly, Nick is the FinTech Connector Shanghai Community Partner where he takes an active role in connecting the Shanghai Fintech community with the rest of the Fintech world.