Vments: Banking Into The Future - Press Release

By Steve Wasserman — Member of FinTech Connector / New York

VmentsTM NON-CRYPTO DISTRIBUTED LEDGER BANKING PLATFORM PARTNERS WITH PHOTON FOR POC DEVELOPMENT

New York, September 21, 2018. Vments, the designers of their patent-pending Enterprise Digital Banking Core Platform and Ecosystem, and Photon Interactive a leading provider of omnichannel digital experiences including full-service creative, application development and architecture design and implementation for many of the Fortune 100, announced their agreement for a strategic resource funded development partnership that they made earlier this summer. Steven Wasserman, CEO, Founder and Architect of Vments, in close collaboration with Photon, have now completed the proof of concept (POC).

Connect with Steve Wasserman via FinTech Connector - https://members.fintechconnector.com/user/sign_up

The POC demonstrates the core of the Vments virtual fiat money (VFM) and smart transaction design that works on top of a hybrid blockchain and off-chain cloud layer network of banks and non-bank financial services. Other aspects of the POC design involve the sophisticated network and security architecture initially leveraging Hyperledger and Fabric for the blockchain layer and AWS as the cloud layer along with applicable security access controls for an interface layer to the individual and business customers of their clients & partners.

Photon’s highly professional team evolved Vments’ detailed specification documents and diagrams as their understanding through standardized Tier 1 level documentation and methodology for this project and product. The value of the POC deliverables to Vments is a step toward the development for the Minimal Viable Product (MVP), slated as the next phase that they are now seeking applicable investor participation and interested clients and partners.

According to Steve Wasserman, “Vments ecosystem allows banks and financial services to visualize, realize, and participate in Banking Into The Future with each other, their customers, and other integrated parties to the ecosystem.”

Mukund Balasubramanian, Photon Co-founder and CTO, said that “Vments approach to the blockchain and digital money is a fully scalable, regulated, and non-crypto based solution that many of our Fortune 100 and 500 clients should be interested in”.

Vments long term design vision enables it’s clients and partners to choose the blockchain and cloud layer of their choice to participate. The ecosystem enables VFM in any fiat currency which can be exchanged for VFM of any other fiat. VFM is not its own currency, nor is based on a cryptocurrency, as are all of the cryptocurrencies and “stablecoins”. It can only be used through Vments’ enterprise functional open APIs use cases that make up the ecosystem.

The first use cases slated for the MVP in 2019 cover peer to peer data and value transfers between consumers and merchants as well as person to person transactions using Vments “true mobile and online digital cash” called CommunityVcash. Visit www.vments.com/CommunityVcash for more.

“Working with innovative startups is part of Photon’s DNA. Investing our resources to help build and bring these new services to fruition is a natural extension of our work with the startup community,” explains Mukund Balasubramanian. “We are always on the hunt for new disruptive companies to bring to our customer base.”

As a result of this strategic partnership, Vments is poised to become the Enterprise Digital Banking (EDB) core platform and ecosystem delivering “Banking Into The Future”.

# # #

VMENTS

Vments is a financial transaction technology provider that delivers virtual and immediate financial transactions software licensing, professional services, and products in innovative and cost-effective ways to fundamentally change the way banks and financial services (FIs) operate and distinguish themselves in the rapidly changing financial services landscape.

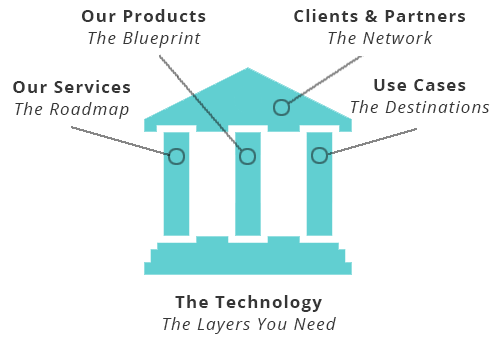

Vments provides an enterprise functional financial ecosystem blueprint and roadmap that revolves around our patent pending Virtual Fiat Money (VFM) value transfers and corresponding Smart Transaction data transfers that are the core to the use cases designed to implement and customize with our partners and clients. The movement of value and data operate through a network of banks and financial services clients and partners. The shared network opens up new functionality and shared costs not previously feasible in the current siloed systems used today.

The value transfers are immediate and follow a “good funds” model with the attributes of bank checks and the flexibility of cash. Our unique design of VFM, also enables it to be securely downloaded and transacted online as well as offline on mobile and other devices. Our first use case calls this “true mobile and online digital cash” CommunityVcash.

Website: https://www.vments.com/

LinkedIn Company Page: https://www.linkedin.com/company/vments/

Media Contact: Mary Olson

Phone: +1.917.656.1856

Email MaryOlson@MaryOlson.biz

PHOTON

Photon is the world’s largest and fastest growing provider of omnichannel digital experiences with over 37 of the Fortune 100 as their digital innovation partner of choice and has the largest digital consumer footprint with over 250mm daily consumer touchpoints. Photon has the largest pool of omnichannel engineers with over 3,800 engineers across offices in the U.S., Canada, Europe, Mauritius, India, shanghai, and Indonesia.

Website: http://www.photon.in/

PhotonWorld 2018: Digital Beyond the Transformation, New York City October 18, 2018. An invitation-only annual event for senior executives in the digital transformation space: http://info.photon.in/photonworld-2018